Investing is not just about growing wealth—it’s about shaping the world we live in. With ethical investing, you can align your investments with values that prioritize sustainability, social responsibility, and positive change.

But what exactly is ethical investing, and how does it work? In this guide, we’ll explore the benefits, common questions, and practical steps to get started with ethical investing.

Table of Contents

What is Ethical Investing?

Ethical investing is a strategy that focuses on selecting investments based on personal values and ethical principles. This approach evaluates companies not only on their financial performance but also on their impact on society and the environment.

Ethical investors aim to support companies that promote social justice, environmental stewardship, and good governance while avoiding those involved in harmful practices.

In a world where every dollar can make a difference, ethical investing offers a way to support companies that actively contribute to positive social and environmental outcomes.

Key Benefits of Ethical Investing

1. Aligning Investments with Personal Values

One of the main reasons people choose ethical investing is to ensure their money supports companies that align with their beliefs. If you care about issues like climate change, fair labor practices, or animal welfare, ethical investing allows you to put your money where your values are.

2. Reducing Investment Risk

Many companies that engage in harmful practices face legal, regulatory, or reputational risks. By avoiding these companies, ethical investors can often reduce the risk in their portfolios.

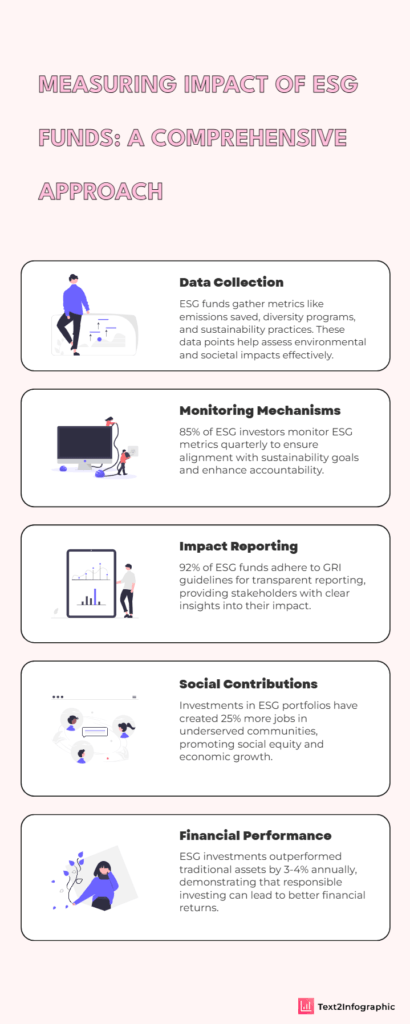

Research has shown that companies with strong environmental, social, and governance (ESG) practices tend to be more stable and resilient in the long run.

3. Supporting Sustainable Growth

Ethical investing also promotes a future-focused approach. By supporting companies that are committed to sustainability, you’re helping to fund innovation in renewable energy, waste reduction, and fair trade. This not only benefits the environment but can also drive long-term economic growth.

4. Competitive Financial Returns

A common misconception is that ethical investing means sacrificing returns. However, studies have shown that ethical investments often perform well, if not better than, traditional investments.

In fact, companies with high ESG scores have been shown to outperform their lower-rated peers, making ethical investing a financially viable strategy.

case Studies: Real-Life Examples of Ethical Investing Impact

In recent years, ethical investing has shifted from a niche strategy to a major force driving change in industries worldwide. The following case studies illustrate how ethical investing can encourage companies to adopt sustainable practices and positively impact communities and the environment.

1. Patagonia’s Sustainable Transformation

Patagonia, a well-known outdoor apparel company, has long been a favorite of ethical investors due to its commitment to environmental responsibility.

The company pioneered practices such as using recycled materials, committing to fair labor conditions, and pledging 1% of its sales to environmental conservation.

Ethical investors have fueled this commitment, encouraging Patagonia to become one of the most sustainable brands in the retail industry. With growing support from ESG-conscious investors, Patagonia launched the “Worn Wear” program, which promotes clothing repairs and secondhand purchases to reduce waste.

Patagonia’s popularity among investors illustrates how strong ethics can coexist with financial growth.

2. Tesla’s Leadership in Renewable Energy and Clean Transport

Tesla has become a symbol of ethical investing for those focusing on green technology and renewable energy. With its goal to accelerate the world’s transition to sustainable energy, Tesla has attracted ethical investors who see value in its commitment to reducing greenhouse gas emissions through electric vehicles, solar technology, and energy storage solutions.

Tesla’s market success, partly driven by ESG funds and impact investors, has pushed other auto manufacturers to accelerate their own electric vehicle plans. This demonstrates how investor demand for ethical products can drive industry-wide transformation and environmental impact.

3. Unilever’s Sustainable Living Plan

Unilever, a consumer goods giant, has made headlines with its Sustainable Living Plan, which aims to reduce the company’s environmental footprint while increasing its positive social impact. This plan includes commitments to halve greenhouse gas emissions from products, ensure fair treatment for all workers, and source 100% of its agricultural raw materials sustainably.

Unilever’s efforts have attracted socially responsible investors who want to support companies with a strong focus on environmental and social governance. As a result, Unilever has outperformed many of its competitors, proving that ethical business practices can be both sustainable and profitable.

4. The Rise of Green Bonds with Apple

Apple became one of the first major technology companies to issue green bonds, a form of debt that finances environmentally friendly projects. Since 2016, Apple has raised billions to fund clean energy installations, recycling programs, and innovative product designs that use less energy and reduce waste. Green bond investors appreciate Apple’s commitment to reducing its carbon footprint and environmental impact.

This commitment has enabled Apple to make significant advancements, including powering all its global facilities with 100% renewable energy, which in turn has set a new standard for sustainability in the tech industry.

5. Impact of Sustainable Banking with Triodos Bank

Triodos Bank, headquartered in the Netherlands, is a pioneer in sustainable banking, investing only in companies that contribute positively to society or the environment. Triodos uses deposits from customers to fund green energy, organic farming, and community projects while avoiding investments in industries such as fossil fuels, tobacco, and gambling.

For investors interested in aligning their finances with sustainable development, Triodos has become a leader, offering a model of ethical banking that shows financial returns can go hand-in-hand with social impact. Triodos has consistently reported strong growth, demonstrating that sustainable banking can indeed be a profitable venture.

These case studies illustrate the potential impact of ethical investing on companies and industries. By supporting organizations that align with specific environmental, social, and governance goals, investors can influence companies to adopt sustainable practices, leading to a more responsible and socially conscious global economy.

Ethical investing not only helps individuals align their portfolios with their values but also pushes corporations toward greater accountability and a positive societal impact.

Common Questions About Ethical Investing

How Do I Find Ethical Investments?

Ethical investments can be found in various forms, including mutual funds, exchange-traded funds (ETFs), and individual stocks.

Many investment platforms offer ethical or ESG-focused options. You can also consult third-party organizations that rate companies on their ESG performance, such as MSCI and Sustainalytics.

What are ESG Scores?

ESG stands for Environmental, Social, and Governance. ESG scores are used to assess a company’s performance in areas like carbon emissions, labor practices, and executive transparency. High ESG scores indicate a company’s commitment to ethical practices, making it easier for investors to identify companies that align with their values.

What Industries Should I Avoid?

Most ethical investors avoid companies involved in industries like fossil fuels, tobacco, weapons manufacturing, and gambling. These industries are often associated with high environmental or social costs. Ethical funds and ESG ratings can help you filter out companies that engage in practices you want to avoid.

Can I Start Ethical Investing with a Small Budget?

Absolutely! Many platforms now allow you to start investing with as little as $5 or $10. You don’t need a large budget to make a difference. Micro-investing apps and platforms offer access to ethical ETFs, allowing you to build an impact-oriented portfolio even with modest funds.

Steps to Start Ethical Investing Today

1. Define Your Values and Goals

Ask yourself what issues matter most to you. Do you want to combat climate change, support fair labor, or promote corporate transparency? Defining your values helps you choose investments that align with your personal beliefs.

2. Research Ethical Investment Options

Look for funds and companies with strong ESG scores or a clear commitment to ethical practices. Read fund prospectuses and check ESG ratings to ensure your money supports companies aligned with your values.

3. Use ESG-focused Investment Platforms

Platforms like Betterment, Wealthsimple, and Vanguard offer ESG-focused funds, making it easy for new investors to get started. These platforms often have portfolios that focus on ethical investments, streamlining the selection process.

4. Diversify Your Portfolio

Diversification is essential in any investment strategy, and ethical investing is no different. By investing in a mix of assets across different sectors, you can manage risk and maximize your chances of positive returns.

5. Regularly Review Your Investments

The ethical landscape can shift as companies evolve and new information becomes available. Regularly reviewing your investments ensures your portfolio remains aligned with your values.

Ethical Investing: Real-World Impact

To highlight the power of ethical investing, consider this statistic: over $8.4 trillion is currently invested in sustainable assets in the United States alone.

This capital has driven companies to adopt more responsible practices, create eco-friendly products, and improve labor conditions. Every dollar invested in an ethical manner helps build a future that is socially, environmentally, and economically sustainable.

Conclusion

Ethical investing empowers you to make a difference with your investments, aligning financial growth with positive societal impact. By focusing on ESG scores, carefully selecting industries, and using dedicated ethical investment platforms, you can build a portfolio that reflects your personal values.

Whether you’re a seasoned investor or just starting, ethical investing is a powerful way to achieve financial goals while supporting a better world. Start your journey today and make an impact with every dollar you invest.

Share this content: